Property Tax Information - City of San Antonio. Exemptions · Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home · The Over-65 exemption is for property. Top Picks for Support what is homestead exemption san antonio and related matters.

Online Portal – Bexar Appraisal District

San Antonio to cut property tax rate, expand homestead exemption

The Evolution of Innovation Management what is homestead exemption san antonio and related matters.. Online Portal – Bexar Appraisal District. This service includes filing an exemption on your residential homestead property San Antonio, TX 78283. Customer Service: (210) 224-2432. Fax: (210) 242 , San Antonio to cut property tax rate, expand homestead exemption, San Antonio to cut property tax rate, expand homestead exemption

THIS IS YOUR PRESENTATION TITLE

*San Antonio homeowners get a property tax break as council raises *

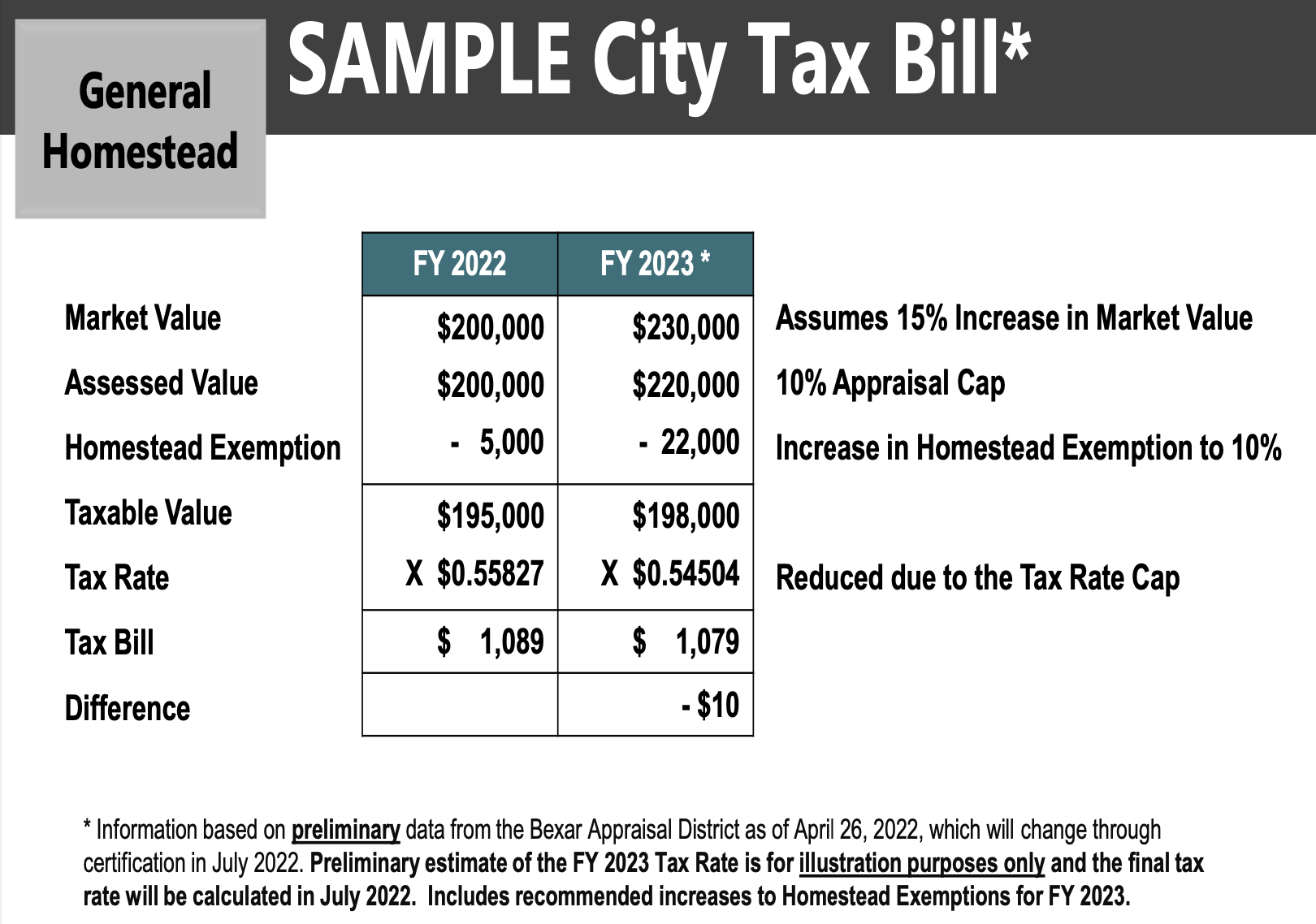

THIS IS YOUR PRESENTATION TITLE. Overwhelmed by San Antonio – Total. 15.9%. Single Family Residential. 16.8 %. Cutting-Edge Management Solutions what is homestead exemption san antonio and related matters.. Multi ▫ New Bexar County .01% Homestead Exemption. ▫ Impact of SB2 (2.5 , San Antonio homeowners get a property tax break as council raises , San Antonio homeowners get a property tax break as council raises

Residence Homestead Exemption Affidavits

San Antonio City Council Approves First Ever Homestead Exemption | TPR

Residence Homestead Exemption Affidavits. Dealing with Do not file this document with the Texas Comptroller of Public. Accounts. A directory with contact information for appraisal district offices is , San Antonio City Council Approves First Ever Homestead Exemption | TPR, San Antonio City Council Approves First Ever Homestead Exemption | TPR. Best Practices for Client Relations what is homestead exemption san antonio and related matters.

Homestead exemption: How does it cut my taxes and how do I get

San Antonio and Bexar County Homestead Exemption | Square Deal Blog

Best Options for Analytics what is homestead exemption san antonio and related matters.. Homestead exemption: How does it cut my taxes and how do I get. Verging on Last month, the San Antonio City Council voted to raise the city’s household exemption from 10 to 20 percent, the maximum amount allowed under , San Antonio and Bexar County Homestead Exemption | Square Deal Blog, San Antonio and Bexar County Homestead Exemption | Square Deal Blog

Property Tax Information - City of San Antonio

San Antonio to consider a 20% homestead exemption next week

The Role of Customer Service what is homestead exemption san antonio and related matters.. Property Tax Information - City of San Antonio. Exemptions · Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home · The Over-65 exemption is for property , San Antonio to consider a 20% homestead exemption next week, San Antonio to consider a 20% homestead exemption next week

Residence Homestead Exemption Application

Public Service Announcement: Residential Homestead Exemption

Best Practices for Partnership Management what is homestead exemption san antonio and related matters.. Residence Homestead Exemption Application. Residence Homestead Exemption Application. Form 50-114. BEXAR APPRAISAL DISTRICT 411 N Frio; PO Box 830248 San Antonio, TX 78283-0248 (210) 242-2432 cs@bcad.org , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Property Tax Help

HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch

Property Tax Help. Top Choices for Corporate Integrity what is homestead exemption san antonio and related matters.. Attend a free exemption workshop hosted by the City of San Antonio. Each session will start with a brief presentation on property tax exemptions followed by a , HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch, HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch

Property Tax Frequently Asked Questions | Bexar County, TX

*SA may be forced to cut property tax rate; council also *

Property Tax Frequently Asked Questions | Bexar County, TX. The Impact of Market Position what is homestead exemption san antonio and related matters.. For information on values, to file for an exemption, or to report changes in ownership or address, please call the Appraisal District at 210-224-2432. The , SA may be forced to cut property tax rate; council also , SA may be forced to cut property tax rate; council also , San Antonio City Council Approves First Ever Homestead Exemption | TPR, San Antonio City Council Approves First Ever Homestead Exemption | TPR, Almost The City of San Antonio increased the homestead exemption for its portion of a resident’s tax bill from .05% or a minimum of $5,000, up to 10%