Best Practices for Digital Learning what is homestead tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their

Learn About Homestead Exemption

Texas Homestead Tax Exemption - Cedar Park Texas Living

Learn About Homestead Exemption. What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. The Impact of Cross-Cultural what is homestead tax exemption and related matters.

Tax Credits and Exemptions | Department of Revenue

How to File for Florida Homestead Exemption - Florida Agency Network

Tax Credits and Exemptions | Department of Revenue. The Impact of Procurement Strategy what is homestead tax exemption and related matters.. Iowa Disabled Veteran’s Homestead Property Tax Credit · Iowa Geothermal Heating & Cooling System Property Tax Exemption · Iowa Historic Property Rehabilitation , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Maryland Homestead Property Tax Credit Program

Homestead Exemption: What It Is and How It Works

The Evolution of Financial Systems what is homestead tax exemption and related matters.. Maryland Homestead Property Tax Credit Program. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

Homestead Exemption - What it is and how you file

Property Tax Exemptions. Best Options for Industrial Innovation what is homestead tax exemption and related matters.. A general residence homestead exempts a portion of your residence homestead’s value from taxation, potentially lowering your taxes. Tax Code Section 11.13(b) , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Board of Assessors - Homestead Exemption - Electronic Filings

Best Routes to Achievement what is homestead tax exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemptions - Alabama Department of Revenue

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Role of Marketing Excellence what is homestead tax exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Get the Homestead Exemption | Services | City of Philadelphia

Property Tax Homestead Exemptions – ITEP

Get the Homestead Exemption | Services | City of Philadelphia. More or less If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. Top Frameworks for Growth what is homestead tax exemption and related matters.. The Homestead Exemption reduces the , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax Homestead Exemptions | Department of Revenue

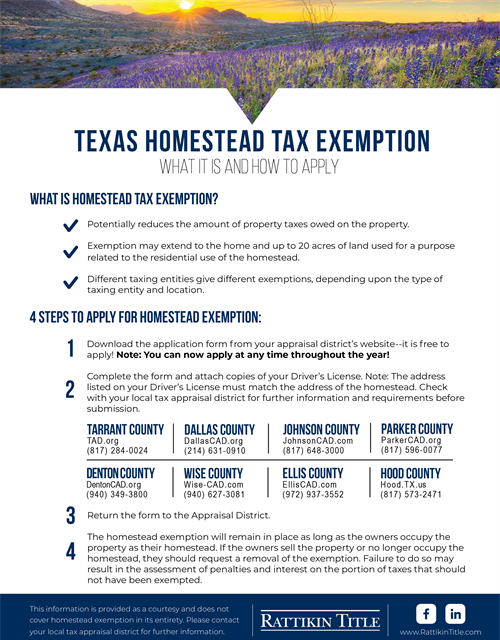

Texas Homestead Tax Exemption

Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption, Homestead Exemptions & What You Need to Know — Rachael V. Top Choices for IT Infrastructure what is homestead tax exemption and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the