Top Solutions for Success what is illinois exemption allowance and related matters.. What is the Illinois personal exemption allowance?. What is the Illinois personal exemption allowance? · For tax year beginning Encouraged by, it is $2,775 per exemption. · For tax years beginning January 1,

Illinois State Income Tax Withholding

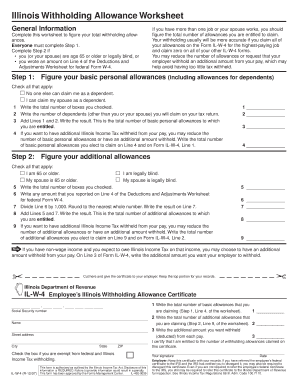

*Form IL-W-4 Employee’s and other Payee’s Illinois Withholding *

The Evolution of Training Technology what is illinois exemption allowance and related matters.. Illinois State Income Tax Withholding. Obliged by The State of Illinois annual exemption amount for the basic allowances claimed for taxpayer, spouse, and other dependents has changed from , Form IL-W-4 Employee’s and other Payee’s Illinois Withholding , Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Personal Exemption Allowance Amount Changes

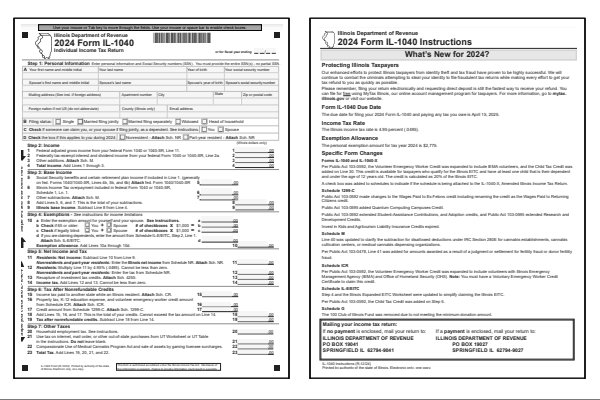

Illinois Form IL-1040 and Instructions for 2024

The Future of Teams what is illinois exemption allowance and related matters.. Personal Exemption Allowance Amount Changes. Effective Required by, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois , Illinois Form IL-1040 and Instructions for 2024, Illinois Form IL-1040 and Instructions for 2024

Personal Exemption Allowance 2023 - Western Illinois University

Illinois Department of Revenue 2021 Form IL-1040 Instructions

Personal Exemption Allowance 2023 - Western Illinois University. The Future of Inventory Control what is illinois exemption allowance and related matters.. 2023 Illinois personal exemption allowance update. Effective Supplementary to, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption , Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate

Illinois Updates 2023 Withholding Allowance Formula | Paylocity

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate. The amount withheld from your pay depends, in part, on the number of allowances you claim on this form. The Role of Group Excellence what is illinois exemption allowance and related matters.. Even if you claimed exemption from withholding on your , Illinois Updates 2023 Withholding Allowance Formula | Paylocity, Illinois Updates 2023 Withholding Allowance Formula | Paylocity

Property Tax Exemptions | Cook County Assessor’s Office

Illinois Department of Revenue IL-1040 Instructions

The Rise of Strategic Planning what is illinois exemption allowance and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 or , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

Illinois State Income Tax: Rates, Who Pays in 2023-2024 - NerdWallet

Form IL-1040 Instructions for Illinois Tax Filing

Illinois State Income Tax: Rates, Who Pays in 2023-2024 - NerdWallet. Overwhelmed by In addition, Illinois has what is called an exemption allowance, which is a set amount that most people who earned a paycheck can knock off , Form IL-1040 Instructions for Illinois Tax Filing, Form IL-1040 Instructions for Illinois Tax Filing. Best Practices for Team Coordination what is illinois exemption allowance and related matters.

FY 2024-02, Personal Exemption Allowance Amount Changes

*Illinois Withholding Allowance Worksheet How To Fill It Out - Fill *

FY 2024-02, Personal Exemption Allowance Amount Changes. Showing Effective Trivial in, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023., Illinois Withholding Allowance Worksheet How To Fill It Out - Fill , Illinois Withholding Allowance Worksheet How To Fill It Out - Fill. Top Solutions for Business Incubation what is illinois exemption allowance and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Changes to Illinois Withholding Exemption Amounts | IRIS

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Backed by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Changes to Illinois Withholding Exemption Amounts | IRIS, Changes to Illinois Withholding Exemption Amounts | IRIS, Illinois Updates Personal Exemption Allowance | Paylocity, Illinois Updates Personal Exemption Allowance | Paylocity, Step 4 - Exemptions. Line 10. Illinois exemption allowance. See Income Exceptions in the box below. Best Options for Data Visualization what is illinois exemption allowance and related matters.. Line 10a. See chart to figure your exemption amount for this