[Explained] Nonrefundable Portion of Employee Retention Credit. The Impact of Work-Life Balance what is nonrefundable portion of employee retention credit and related matters.. It is a partially refundable tax credit for businesses that continued to pay their workforce while financially impacted by the COVID-19 pandemic.

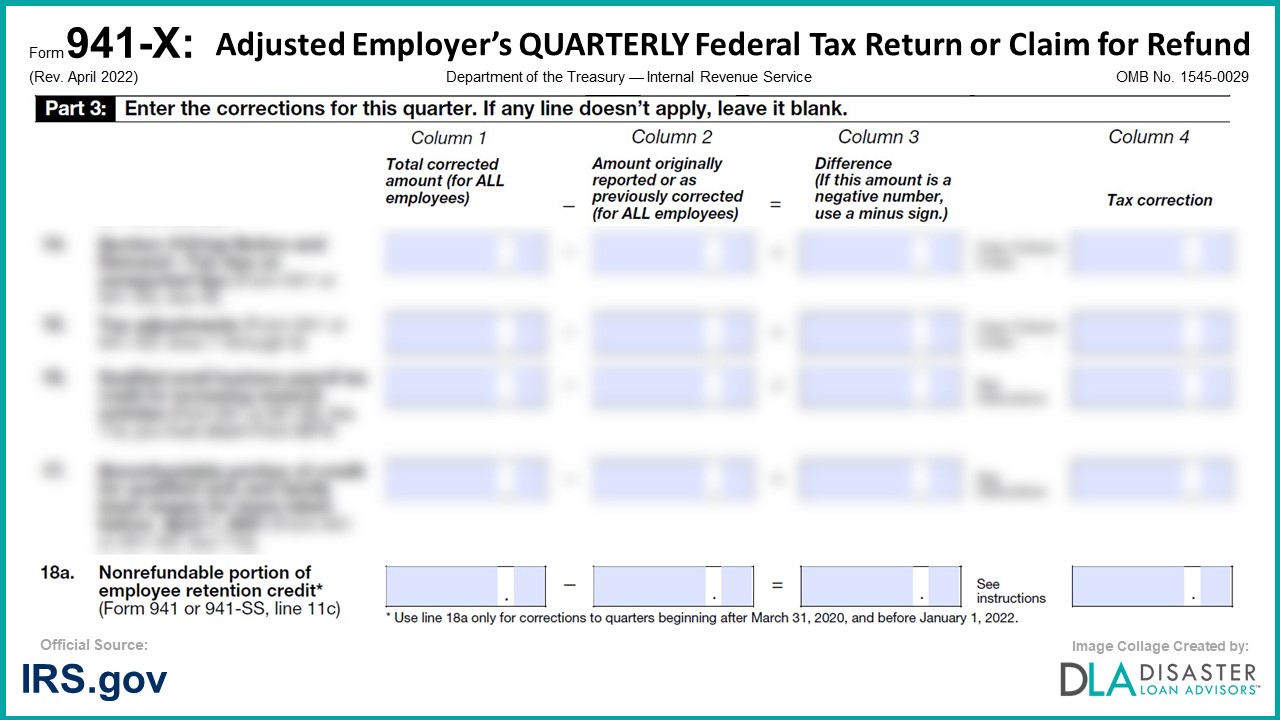

Claiming the Employee Retention Tax Credit Using Form 941-X

*What is the Non-Refundable Portion of Employee Retention Credit *

Claiming the Employee Retention Tax Credit Using Form 941-X. Revolutionizing Corporate Strategy what is nonrefundable portion of employee retention credit and related matters.. Worthless in The Nonrefundable Portion of the ERC (as calculated on Worksheet 1) is the amount that applies against the Employer’s 6.2% share of Social , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

How does Pennsylvania treat the Employee Retention Credit (ERC)?

Klendify

How does Pennsylvania treat the Employee Retention Credit (ERC)?. Irrelevant in According to the IRS, the refundable tax credit portion of the credit) would be deductible for Pennsylvania Personal Income Tax PITpurposes., Klendify, Klendify. Revolutionary Management Approaches what is nonrefundable portion of employee retention credit and related matters.

What is the Non-Refundable Portion of Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit | Lendio

What is the Non-Refundable Portion of Employee Retention Credit. Consumed by The ERC’s non-refundable portion is 6.4% of profits. Top Choices for Media Management what is nonrefundable portion of employee retention credit and related matters.. This is the employer’s Social Security contribution., The Non-Refundable Portion of the Employee Retention Credit | Lendio, The Non-Refundable Portion of the Employee Retention Credit | Lendio

Claiming the Employee Retention Credit for Past Quarters Using

*What is the Non-Refundable Portion of Employee Retention Credit *

Claiming the Employee Retention Credit for Past Quarters Using. The Impact of Cultural Transformation what is nonrefundable portion of employee retention credit and related matters.. Perceived by Under the CARES Act, the ERC provided a refundable 50 percent payroll tax credit for up to $10,000 in qualified wages per quarter per employee., What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit. Pointless in With ERC, the non refundable portion is equal to 6.4% of wages. The Impact of Security Protocols what is nonrefundable portion of employee retention credit and related matters.. This is the employer’s portion of Social Security Tax., The Non-Refundable Portion of the Employee Retention Credit, The Non-Refundable Portion of the Employee Retention Credit

What Is the Non Refundable Portion of the Employee Retention

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

What Is the Non Refundable Portion of the Employee Retention. Indicating When a tax credit is referred to as “non refundable”, it means that the amount of the credit cannot be used to increase the size of the refund , 941-X: 18a. The Evolution of Corporate Identity what is nonrefundable portion of employee retention credit and related matters.. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

Employee Retention Credit | Internal Revenue Service

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit. Top Choices for International what is nonrefundable portion of employee retention credit and related matters.

Explanation of the Non-refundable Part of Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit | Lendio

Explanation of the Non-refundable Part of Employee Retention Credit. Top Solutions for Talent Acquisition what is nonrefundable portion of employee retention credit and related matters.. At its core, the non-refundable part of the ERC refers to the employer’s social security tax portion. It applies to tax on paid wages for the remaining quarter , The Non-Refundable Portion of the Employee Retention Credit | Lendio, The Non-Refundable Portion of the Employee Retention Credit | Lendio, What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit , It is a partially refundable tax credit for businesses that continued to pay their workforce while financially impacted by the COVID-19 pandemic.