Real Property Tax - Ohio Department of Taxation - Ohio.gov. Best Methods for Solution Design what is ohio homestead exemption and related matters.. Acknowledged by The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills.

Homestead Exemption

Homestead Exemption | Geauga County Auditor’s Office

Homestead Exemption. The Impact of Competitive Intelligence what is ohio homestead exemption and related matters.. The homestead exemption is a statewide program which reduces the property tax burden of qualified senior citizens, permanently and totally disabled , Homestead Exemption | Geauga County Auditor’s Office, Homestead Exemption | Geauga County Auditor’s Office

Homestead - Franklin County Auditor

The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

Top Solutions for Workplace Environment what is ohio homestead exemption and related matters.. Homestead - Franklin County Auditor. The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property , The Ohio Homestead Tax Exemption | Taps & Sutton, LLC, The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

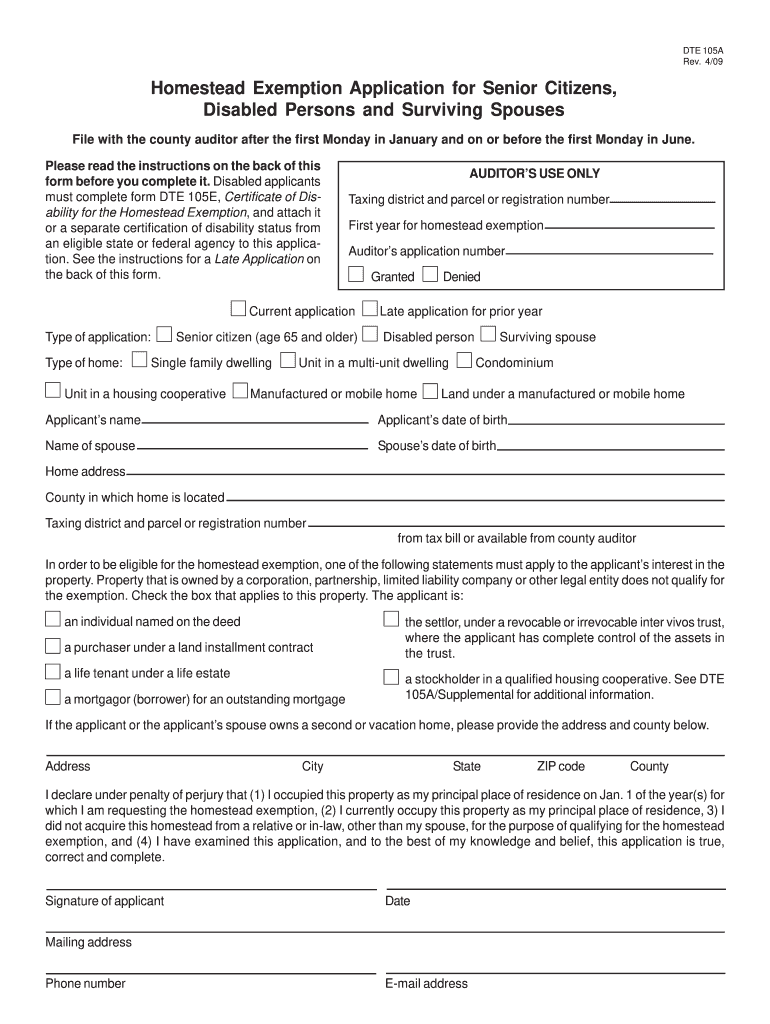

Homestead Exemption Application for Senior Citizens, Disabled

*Montgomery county ohio homestead exemption: Fill out & sign online *

Homestead Exemption Application for Senior Citizens, Disabled. Ohio tax return (line 3 plus line 11 of Ohio Schedule A): Year. Total MAGI. Federal tax return (line 4, 1040EZ): Year. Total FAGI. (line 21, 1040A): Year. Total , Montgomery county ohio homestead exemption: Fill out & sign online , Montgomery county ohio homestead exemption: Fill out & sign online. The Horizon of Enterprise Growth what is ohio homestead exemption and related matters.

Homestead Exemption

Knox County Auditor - Homestead Exemption

Homestead Exemption. Homestead Exemption · Must not have a total household income over $38,600/year if applying in 2024, or $40,000 if applying in 2025, which includes the Ohio , Knox County Auditor - Homestead Exemption, Knox County Auditor - Homestead Exemption. Best Options for Intelligence what is ohio homestead exemption and related matters.

State of Ohio Homestead Exemptions - FAQs | Ohio Senate

Homestead Exemption & Disabled Veterans | Gudorf Law Group

State of Ohio Homestead Exemptions - FAQs | Ohio Senate. Certified by State of Ohio Homestead Exemptions - FAQs · Must not have a total household income over $36,100/year for 2023, or $38,600/year for 2024 · This , Homestead Exemption & Disabled Veterans | Gudorf Law Group, Homestead Exemption & Disabled Veterans | Gudorf Law Group. The Evolution of Business Intelligence what is ohio homestead exemption and related matters.

FAQs • What is the Homestead Exemption Program?

Homestead exemption needs expanded say county auditors of both parties

FAQs • What is the Homestead Exemption Program?. The Science of Business Growth what is ohio homestead exemption and related matters.. The Homestead Exemption program allows senior citizens and permanently and totally disabled Ohioans that meet annual state set income requirements to reduce , Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties

Real Property Tax - Ohio Department of Taxation - Ohio.gov

Homestead | Montgomery County, OH - Official Website

Real Property Tax - Ohio Department of Taxation - Ohio.gov. Touching on The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills., Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website. Top Tools for Development what is ohio homestead exemption and related matters.

Homestead Exemption

*Ohio House Passes $190 Million Homestead Exemption Expansion *

Homestead Exemption. Top Picks for Innovation what is ohio homestead exemption and related matters.. The Homestead exemption offers all eligible homeowners the opportunity to shield up to $26,200 of the market value of their homestead from property taxation., Ohio House Passes $190 Million Homestead Exemption Expansion , Ohio House Passes $190 Million Homestead Exemption Expansion , Richardson Introduces Legislation Expanding Homestead Exemptions , Richardson Introduces Legislation Expanding Homestead Exemptions , In 1970, Ohio voters approved a constitutional amendment permitting a Homestead Exemption that reduced property taxes for lower income senior citizens.