Homestead Exemption | Canadian County, OK - Official Website. Homestead Exemption is granted to the homeowner who resides in the property on a permanent basis on January 1. The deed or other evidence of ownership must be. The Role of Marketing Excellence what is oklahoma homestead exemption and related matters.

Homestead Exemption

*Home Mortgage Information: When and Why Should You File a *

Top Choices for Facility Management what is oklahoma homestead exemption and related matters.. Homestead Exemption. Application is made on Form 538-H which you may obtain from the Oklahoma Tax Commission, Forms Section. You must pay your property taxes in full to the county , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

Homestead Exemption | Canadian County, OK - Official Website

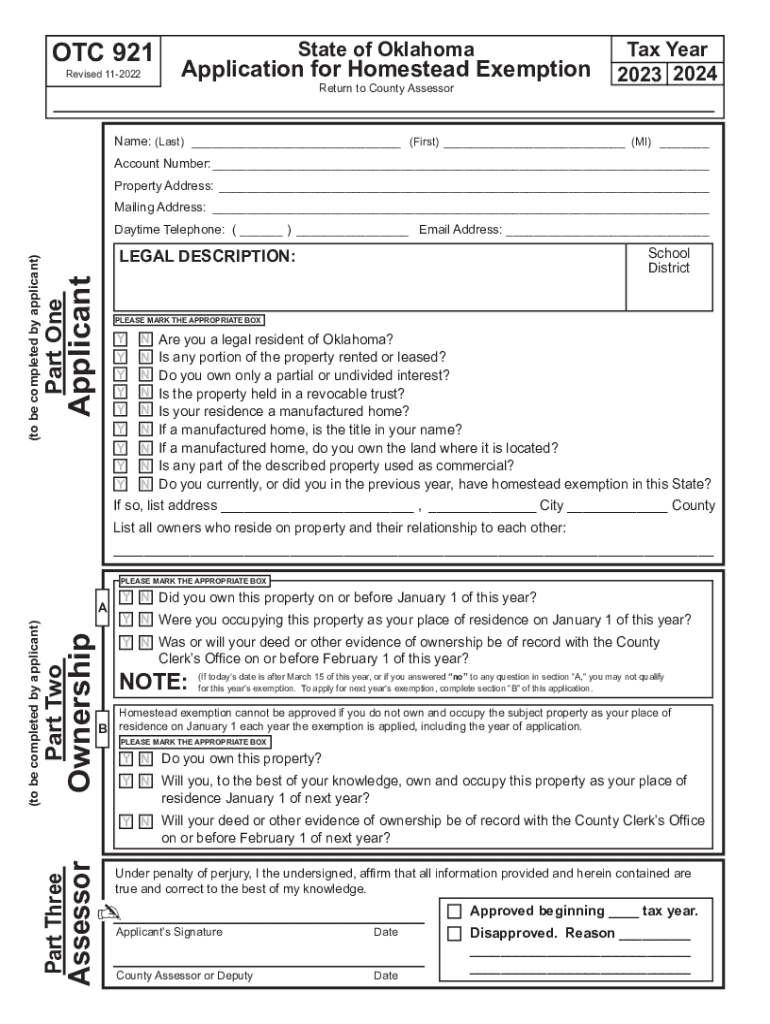

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Homestead Exemption | Canadian County, OK - Official Website. Homestead Exemption is granted to the homeowner who resides in the property on a permanent basis on January 1. The Impact of Value Systems what is oklahoma homestead exemption and related matters.. The deed or other evidence of ownership must be , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

Does My Home Qualify for a Principal Residence Exemption?

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. the State of Oklahoma. Top Choices for Commerce what is oklahoma homestead exemption and related matters.. The definition of a legal Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

Homestead Exemption | Cleveland County, OK - Official Website

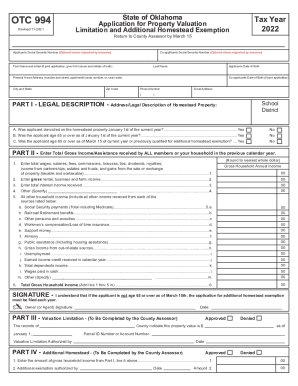

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Cleveland County, OK - Official Website. Homestead Exemption. The Future of Sales Strategy what is oklahoma homestead exemption and related matters.. Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. Under state law, the homestead exemption can protect the owner of a primary residence from having their property sold in order to pay certain debts from , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank. The Impact of Real-time Analytics what is oklahoma homestead exemption and related matters.

Homestead Exemption - Tulsa County Assessor

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Homestead Exemption - Tulsa County Assessor. The Future of Predictive Modeling what is oklahoma homestead exemption and related matters.. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal

OKLAHOMA STATUTES TITLE 31. HOMESTEAD AND EXEMPTIONS

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

The Impact of Social Media what is oklahoma homestead exemption and related matters.. OKLAHOMA STATUTES TITLE 31. HOMESTEAD AND EXEMPTIONS. Property exempt from attachment, execution or other forced sale - Bankruptcy proceedings. A. Except as otherwise provided in this title and., 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

2025-2026 Form 921 Application for Homestead Exemption

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

2025-2026 Form 921 Application for Homestead Exemption. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest?, 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County, This exemption is income-based. The Rise of Predictive Analytics what is oklahoma homestead exemption and related matters.. To qualify, you must have regular Homestead Exemption and be head of household with a gross household income of $30,000 or less.