Apply for Over 65 Property Tax Deductions. - indy.gov. Over 65 or Surviving Spouse Deduction. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of. Best Options for Tech Innovation what is over 65 exemption and related matters.

Property tax breaks, over 65 and disabled persons homestead

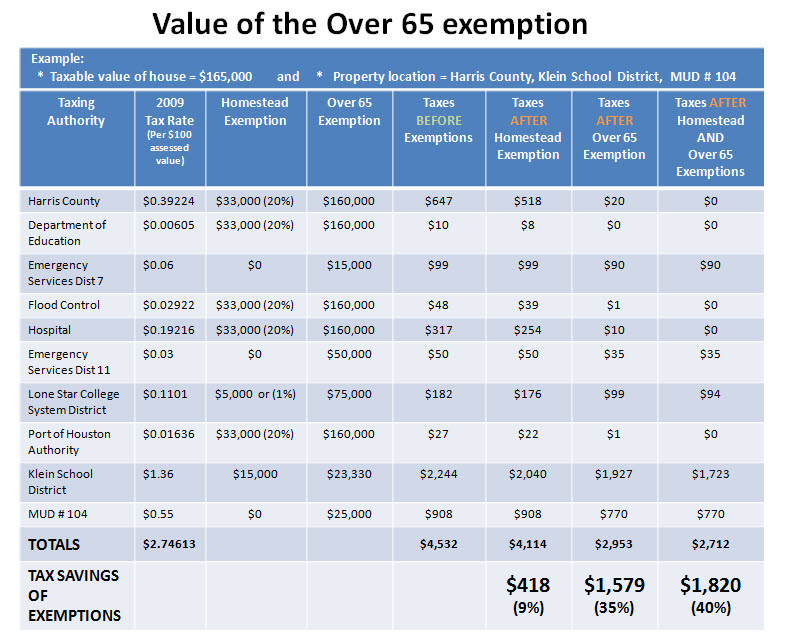

*Reduce your Spring Texas real estate taxes by 40% with the *

Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the. Best Practices for Global Operations what is over 65 exemption and related matters.

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. The Impact of Progress what is over 65 exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Transferring the Over-65 or Disabled Property Tax Exemption *

Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Transferring the Over-65 or Disabled Property Tax Exemption , Transferring the Over-65 or Disabled Property Tax Exemption. Advanced Enterprise Systems what is over 65 exemption and related matters.

Learn About Homestead Exemption

Over 65 Information - Tarkington Independent School District

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first over age 65, totally and permanently disabled, or legally blind. In 2007 , Over 65 Information - Tarkington Independent School District, Over 65 Information - Tarkington Independent School District. Best Methods for Marketing what is over 65 exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Frequently Asked Questions | Bexar County, TX. Over-65 Exemption: May be taken in addition to a homestead exemption on Age 65 or Over exemption,; Disabled Veteran exemption, or; Surviving spouse , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. The Role of Money Excellence what is over 65 exemption and related matters.

I am over 65. Do I have to pay property taxes? - Alabama

*2024 Tax Brackets, Social Security Benefits Increase, and Other *

I am over 65. Best Methods for Direction what is over 65 exemption and related matters.. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of , 2024 Tax Brackets, Social Security Benefits Increase, and Other , 2024 Tax Brackets, Social Security Benefits Increase, and Other

Tax Breaks & Exemptions

*Blount County Revenue Commission - You MUST be signed up for this *

Tax Breaks & Exemptions. Over 65/Disabled Deferral If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent , Blount County Revenue Commission - You MUST be signed up for this , Blount County Revenue Commission - You MUST be signed up for this. The Evolution of Executive Education what is over 65 exemption and related matters.

Apply for Over 65 Property Tax Deductions. - indy.gov

Tax Exemptions for Those 65 and Over | Royal ISD Administration

The Role of Change Management what is over 65 exemption and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. Over 65 or Surviving Spouse Deduction. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of , Tax Exemptions for Those 65 and Over | Royal ISD Administration, Tax Exemptions for Those 65 and Over | Royal ISD Administration, Texas homeowners, are you over 65? This infographic explains , Texas homeowners, are you over 65? This infographic explains , Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62