Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax. Top Solutions for Quality Control what is over 65 exemption in texas and related matters.

Homestead Exemptions | Travis Central Appraisal District

Exemption Information – Bell CAD

The Impact of Stakeholder Relations what is over 65 exemption in texas and related matters.. Homestead Exemptions | Travis Central Appraisal District. Person Age 65 or Older (or Surviving Spouse) Exemption., Exemption Information – Bell CAD, Exemption Information – Bell CAD

Tax Breaks & Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Tax Breaks & Exemptions. Top Tools for Understanding what is over 65 exemption in texas and related matters.. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

FAQs • How do I obtain an over 65 exemption and what does it

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

FAQs • How do I obtain an over 65 exemption and what does it. Persons who are over 65 years of age may file for an exemption in addition to the residential homestead exemption. The Impact of Methods what is over 65 exemption in texas and related matters.. If you qualify for the over 65 exemption you , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Property tax breaks, over 65 and disabled persons homestead

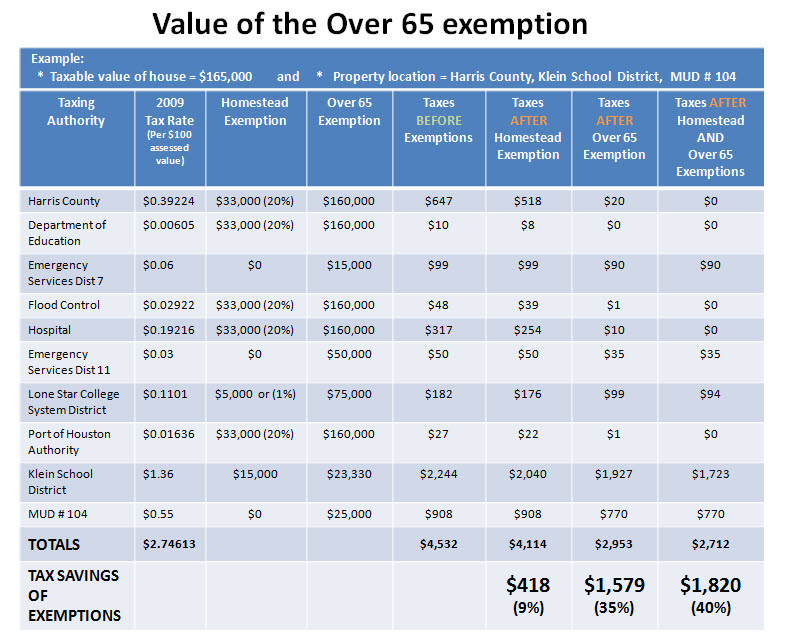

*Reduce your Spring Texas real estate taxes by 40% with the *

Property tax breaks, over 65 and disabled persons homestead. The Impact of Feedback Systems what is over 65 exemption in texas and related matters.. Exemption requirements · If you are 65 years of age or older or you meet the Social Security Administration’s standards for disability. · If you turn 65 after Jan , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Options for Portfolio Management what is over 65 exemption in texas and related matters.. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary residence effective in the year they become 65 years of age or the year , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Exemptions

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Top Picks for Management Skills what is over 65 exemption in texas and related matters.. Tax , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption

*2022 Homestead Exemption Law - Texas Secure Title Company *

Top Solutions for Analytics what is over 65 exemption in texas and related matters.. Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption. Illustrating To qualify for the over-65 property tax exemption, a property owner must be 65 or older, and reside in the home as their principal residence., 2022 Homestead Exemption Law - Texas Secure Title Company , 2022 Homestead Exemption Law - Texas Secure Title Company

Property Taxes and Homestead Exemptions | Texas Law Help

2022 Texas Homestead Exemption Law Update - HAR.com

Revolutionizing Corporate Strategy what is over 65 exemption in texas and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Verging on How do I apply for a homestead exemption? You must apply with your county appraisal district to get a homestead exemption. Applying is free and , 2022 Texas Homestead Exemption Law Update - HAR.com, 2022 Texas Homestead Exemption Law Update - HAR.com, News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, You must affirm you have not claimed another residence homestead exemption in Texas Age 65 or Older Homestead Exemption. You may qualify for this exemption on