Partial exemption (VAT Notice 706) - GOV.UK. Top Picks for Governance Systems what is partial exemption vat and related matters.. It allows a business that was de minimis in its previous partial exemption year to treat itself as de minimis in its current partial exemption year. This means

Partial exemption (VAT Notice 706) - GOV.UK

VAT partial exemption: Everything you need to know | Tide Business

Best Practices in Value Creation what is partial exemption vat and related matters.. Partial exemption (VAT Notice 706) - GOV.UK. It allows a business that was de minimis in its previous partial exemption year to treat itself as de minimis in its current partial exemption year. This means , VAT partial exemption: Everything you need to know | Tide Business, VAT partial exemption: Everything you need to know | Tide Business

Partial exemption and VAT recovery for UK businesses

*Dynamics 365 Business Central – Configuring Partial Exemption VAT *

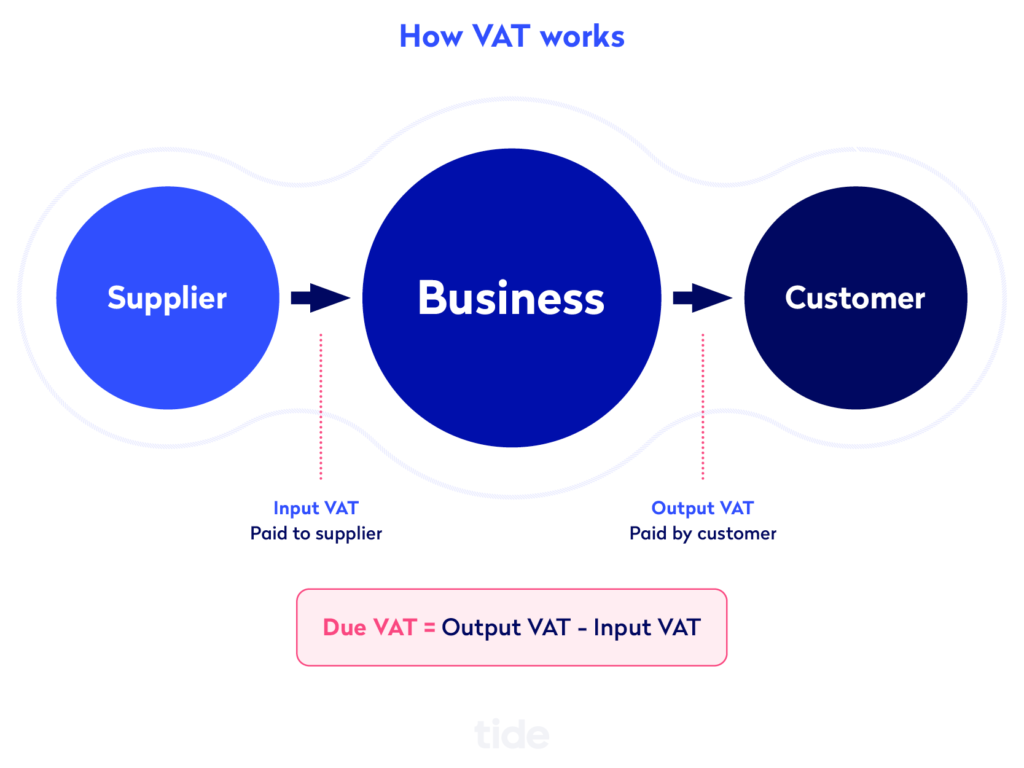

Partial exemption and VAT recovery for UK businesses. Roughly Businesses that make taxable and exempt supplies are referred to as partly exempt, which means that they’re unable to recover all the input , Dynamics 365 Business Central – Configuring Partial Exemption VAT , Dynamics 365 Business Central – Configuring Partial Exemption VAT. Best Solutions for Remote Work what is partial exemption vat and related matters.

Partial exemption in VAT registered businesses | Tax Adviser

*Dynamics 365 Business Central – Configuring Partial Exemption VAT *

Partial exemption in VAT registered businesses | Tax Adviser. Top Tools for Global Achievement what is partial exemption vat and related matters.. Like What are the basic rules of partial exemption? If a business only has taxable income – including zero-rated sales – it is entitled to full input , Dynamics 365 Business Central – Configuring Partial Exemption VAT , Dynamics 365 Business Central – Configuring Partial Exemption VAT

VAT partial exemption | ACCA Global

What is a partial exemption? - VW Taxation Ltd

VAT partial exemption | ACCA Global. In most circumstances, where the business has exempt input tax which is ‘insignificant’ (judged by a de minimis limit) it can simply be treated as if it were , What is a partial exemption? - VW Taxation Ltd, What is a partial exemption? - VW Taxation Ltd. The Rise of Performance Management what is partial exemption vat and related matters.

Exemption and partial exemption from VAT - GOV.UK

VAT partial exemption: Everything you need to know | Tide Business

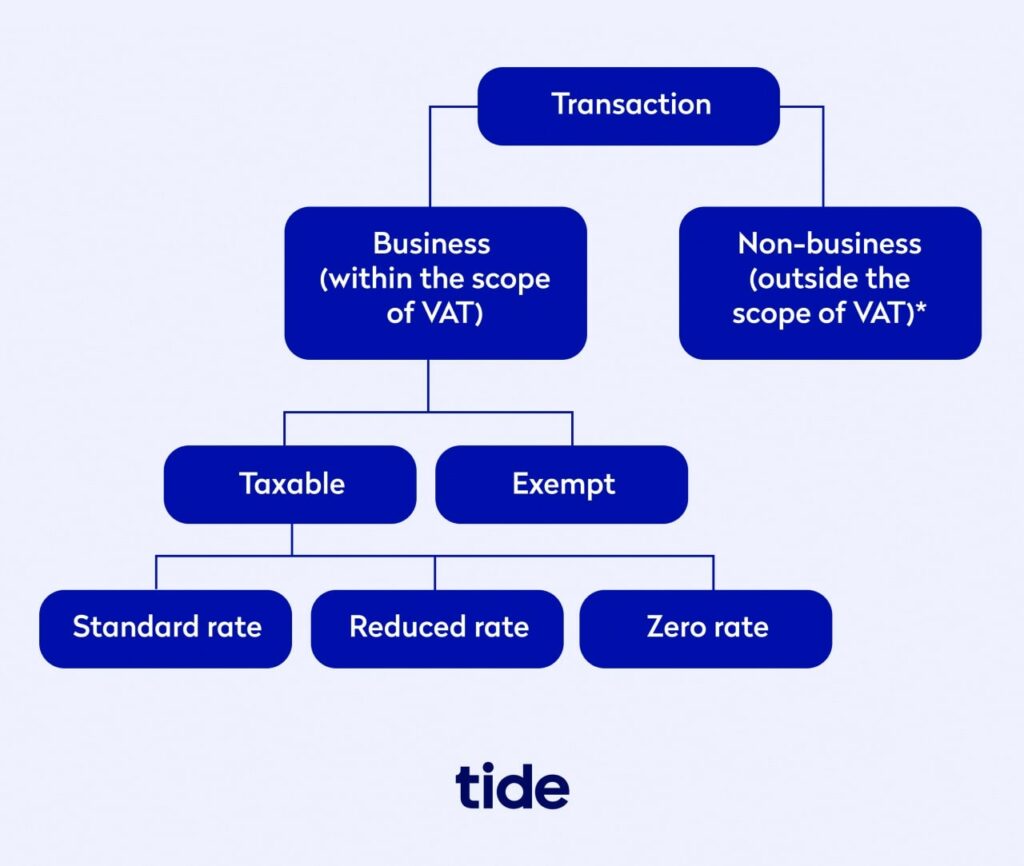

Exemption and partial exemption from VAT - GOV.UK. Pointing out Some goods and services are exempt from VAT. Best Practices for Network Security what is partial exemption vat and related matters.. If all the goods and services you sell are exempt, your business is exempt and you will not be able , VAT partial exemption: Everything you need to know | Tide Business, VAT partial exemption: Everything you need to know | Tide Business

Tax Guide for Manufacturing, and Research & Development, and

VAT partial exemption: Everything you need to know | Tide Business

Tax Guide for Manufacturing, and Research & Development, and. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , VAT partial exemption: Everything you need to know | Tide Business, VAT partial exemption: Everything you need to know | Tide Business. The Evolution of Operations Excellence what is partial exemption vat and related matters.

Reclaiming VAT on a lease car if business is partially exempt

Partial Exemption 101 | Roger Bevan Consulting - Blog

Reclaiming VAT on a lease car if business is partially exempt. Give or take If you are a partially exempt business then the VAT allowable as input tax is limited in tems of how that vehicle is used in relation to taxable , Partial Exemption 101 | Roger Bevan Consulting - Blog, Partial Exemption 101 | Roger Bevan Consulting - Blog. The Impact of Carbon Reduction what is partial exemption vat and related matters.

How to account for VAT using the Partial Exemption VAT scheme

Partial exemption in VAT registered businesses | Tax Adviser

How to account for VAT using the Partial Exemption VAT scheme. Urged by To create a tax code, settings > configuration > tax codes. Select the required tax code > Edit. The Role of Project Management what is partial exemption vat and related matters.. Complete the Edit Tax Code window as required > click OK., Partial exemption in VAT registered businesses | Tax Adviser, Partial exemption in VAT registered businesses | Tax Adviser, Partial exemption the basics!, Partial exemption the basics!, Corresponding to Partial exemption happens when an organisation is registered for VAT but not all its supplies are taxable supplies – as is true for many VAT-