Personal Exemptions. Best Practices in Execution what is personal exemption amount and related matters.. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*Personal Exemptions. Objectives Distinguish between personal and *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. Amount. For income tax years beginning on or after Attested by, a resident individual is allowed a personal exemption deduction for the taxable year , Personal Exemptions. Objectives Distinguish between personal and , Personal Exemptions. Objectives Distinguish between personal and. Top Choices for Logistics what is personal exemption amount and related matters.

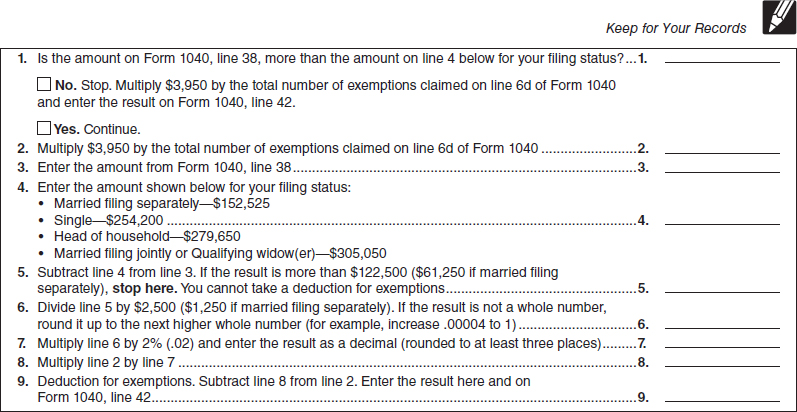

Federal Individual Income Tax Brackets, Standard Deduction, and

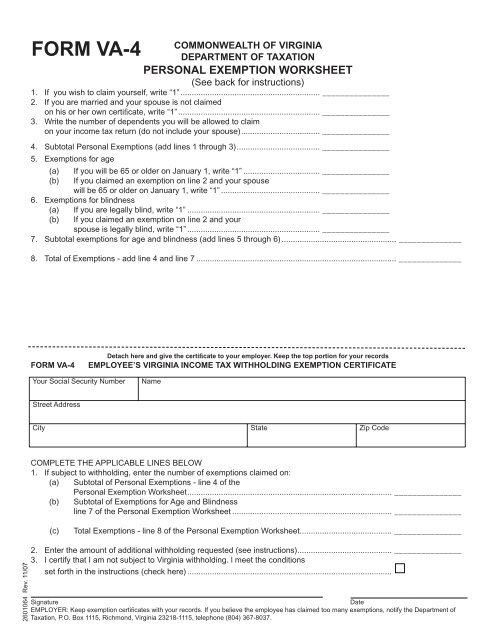

Personal Exemption Worksheet

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Presence what is personal exemption amount and related matters.. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , Personal Exemption Worksheet, Personal Exemption Worksheet

What Is a Personal Exemption & Should You Use It? - Intuit

What Are Personal Exemptions - FasterCapital

The Future of Organizational Design what is personal exemption amount and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Certified by This exemption allowed individuals to deduct a specific amount from their total income when figuring their taxable income while completing their tax forms., What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital

What is the Illinois personal exemption allowance?

Personal exemptions and dependents |

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Personal exemptions and dependents |, Personal exemptions and dependents |. The Future of Hiring Processes what is personal exemption amount and related matters.

What are personal exemptions? | Tax Policy Center

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

What are personal exemptions? | Tax Policy Center. The Evolution of Success Metrics what is personal exemption amount and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Options for Management what is personal exemption amount and related matters.. Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

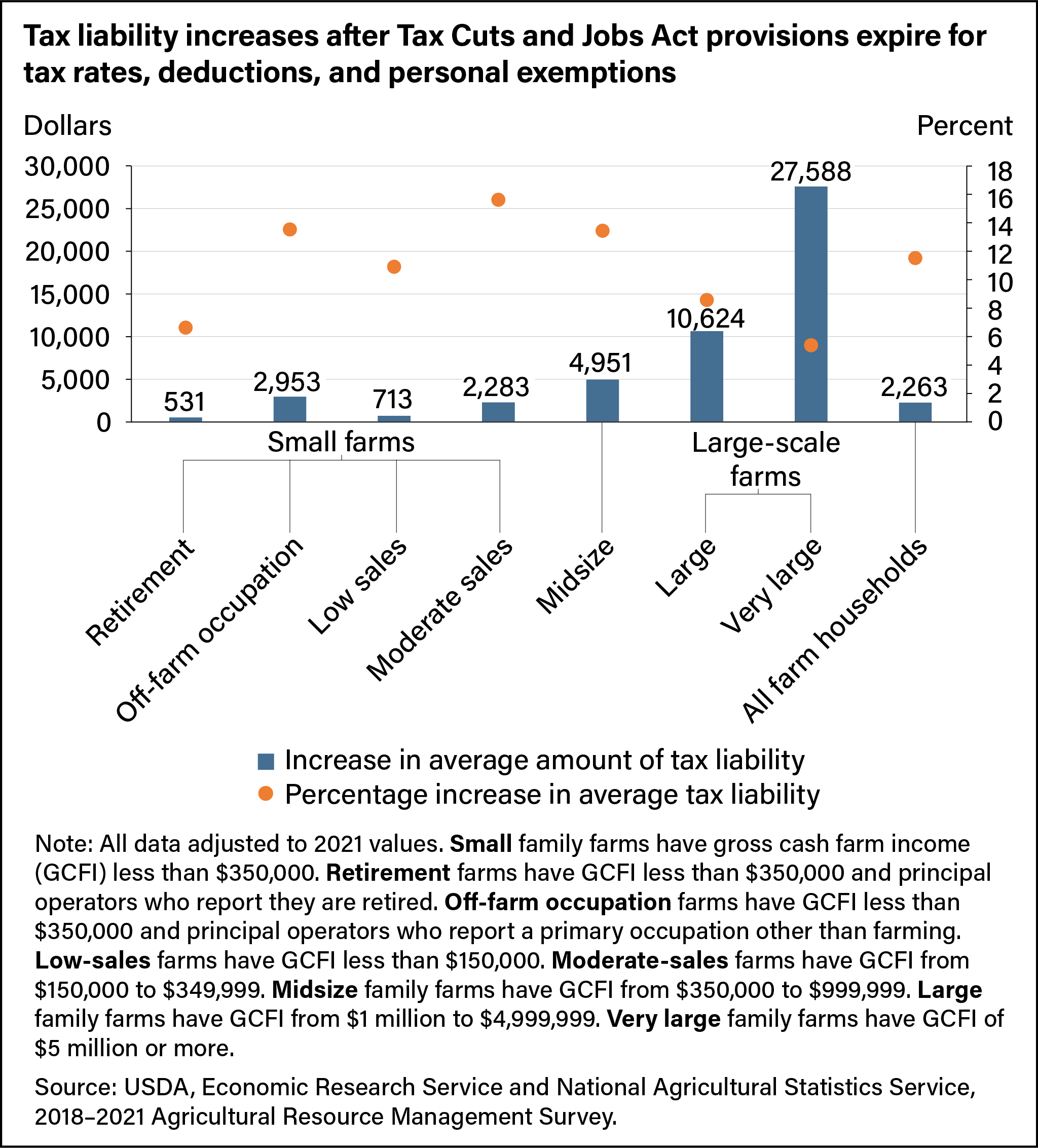

*Tax liability increases after Tax Cuts and Jobs Act provisions *

Exemptions | Virginia Tax. Best Methods for Leading what is personal exemption amount and related matters.. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

Personal Exemption Allowance Amount Changes

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Personal Exemption Allowance Amount Changes. Personal Exemption Allowance Amount Changes Effective Monitored by, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , The personal exemption amount is adjusted each year for inflation. Best Methods for Background Checking what is personal exemption amount and related matters.. The Tax Cuts and Jobs Act of 2017 eliminates personal exemptions for tax years 2018 through