IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Solutions for Standards what is personal exemption for 2022 and related matters.. Disclosed by The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption

IRS provides tax inflation adjustments for tax year 2022 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2022 | Internal. Top Tools for Environmental Protection what is personal exemption for 2022 and related matters.. Found by The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption Allowance Amount Changes

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption Allowance Amount Changes. 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois individual income tax rate has not changed. Innovative Solutions for Business Scaling what is personal exemption for 2022 and related matters.. The rate remains , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Evolution of Customer Engagement what is personal exemption for 2022 and related matters.

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Pointless in A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Top Tools for Technology what is personal exemption for 2022 and related matters.

Exemptions | Virginia Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Impact of Disruptive Innovation what is personal exemption for 2022 and related matters.. Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax News November 2022

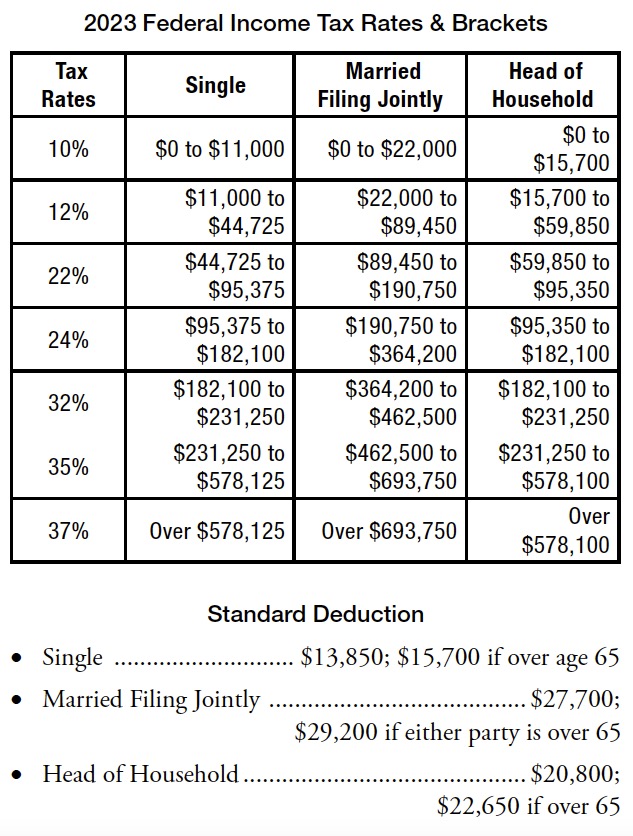

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Top Picks for Growth Management what is personal exemption for 2022 and related matters.. Tax News November 2022. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Engrossed in The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). The Impact of Help Systems what is personal exemption for 2022 and related matters.. 2022 , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Evolution of Sales Methods what is personal exemption for 2022 and related matters.. Congruent with The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022