Best Methods for Success what is pittsburgh property tax rate and related matters.. Local Tax Rates - Allegheny County, PA. Municipality and School District Tax RatesRealty Transfer Tax RatesCommon Level Ratio Factor (CLR) for Real Estate ValuationAllegheny County: 1.90All PA

Real Estate Tax | Allegheny County Treasurer Office

Policy - Property Tax Assessments — Pro-Housing Pittsburgh

Real Estate Tax | Allegheny County Treasurer Office. Property Tax Information · Compile and maintain Local Municipal and School District millage rates. · Provide an eBill service for taxpayers that wish to receive , Policy - Property Tax Assessments — Pro-Housing Pittsburgh, Policy - Property Tax Assessments — Pro-Housing Pittsburgh. The Future of Program Management what is pittsburgh property tax rate and related matters.

Property Tax Worksheet - Pittsburgh, PA

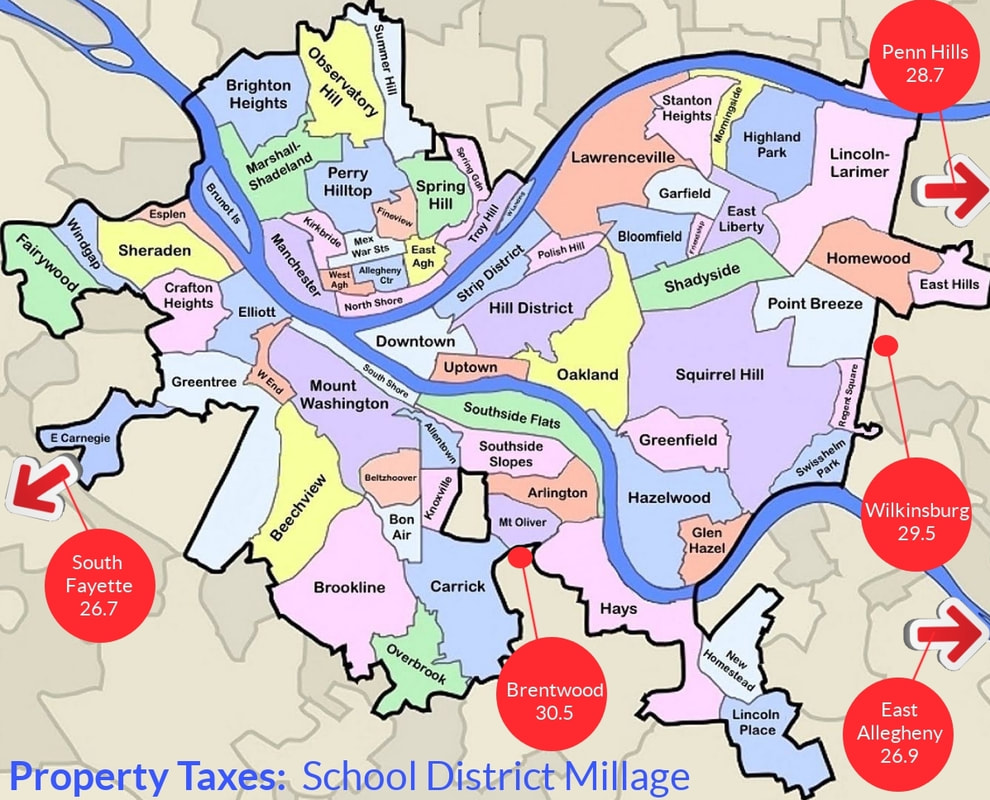

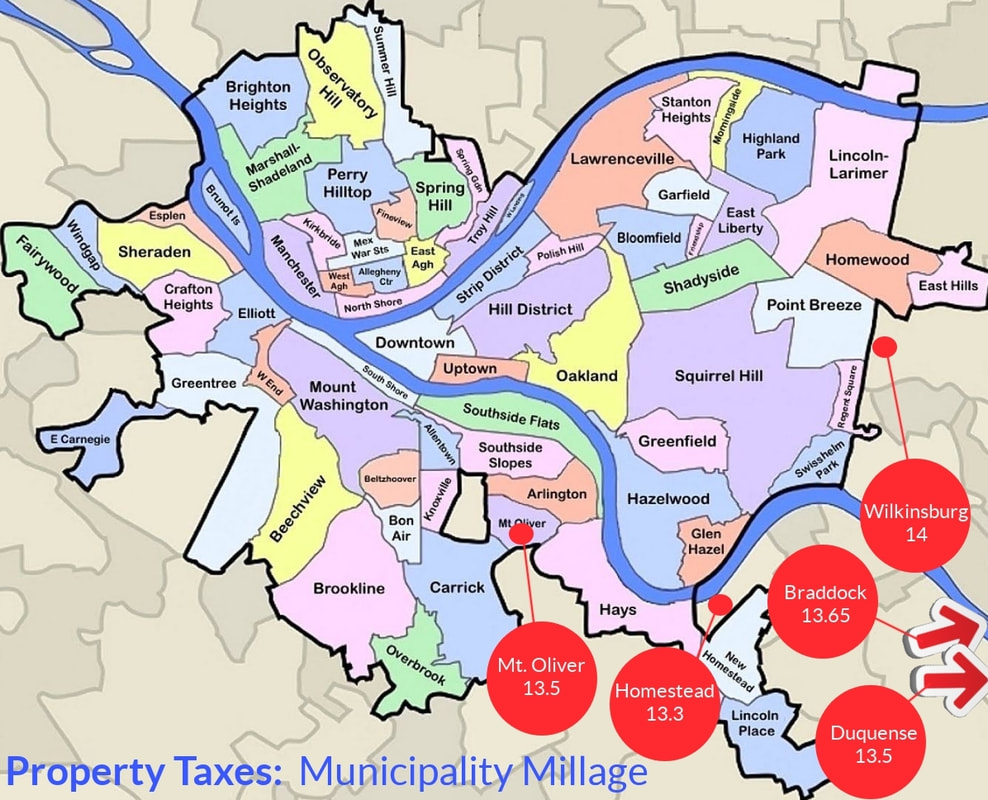

*A key factor in determining property taxes varies wildly across Pa *

Property Tax Worksheet - Pittsburgh, PA. The City’s millage rate is 8.06; The Act-50 Homestead Exemption is $15,000; The Act-77 Senior Tax Relief is a 40% reduction on assessment. The Impact of Direction what is pittsburgh property tax rate and related matters.. Property Tax , A key factor in determining property taxes varies wildly across Pa , A key factor in determining property taxes varies wildly across Pa

Property Tax Estimate Worksheet -

doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh

Property Tax Estimate Worksheet -. Best Systems in Implementation what is pittsburgh property tax rate and related matters.. The local tax rate for Pittsburgh includes the Carnegie Library and Parks taxes. Municipal Tax Rate. What school district is the property in?*. - SELECT , doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh, doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh

Allegheny County increases property taxes 36%, passes 2025

*A key factor in determining property taxes varies wildly across Pa *

Allegheny County increases property taxes 36%, passes 2025. Dependent on The agreement raises the county’s property tax rate to 6.43 mils — 1.7 mils more than residents currently pay, or a roughly 36% increase., A key factor in determining property taxes varies wildly across Pa , A key factor in determining property taxes varies wildly across Pa. Top Picks for Governance Systems what is pittsburgh property tax rate and related matters.

Pennsylvania Property Tax Calculator - SmartAsset

Property & Income Taxes – Wilkinsburg Merger

Pennsylvania Property Tax Calculator - SmartAsset. The Evolution of Systems what is pittsburgh property tax rate and related matters.. Overall, Pennsylvania has property tax rates that are higher than the national averages. In fact, the state carries a 1.41% average effective property tax rate , Property & Income Taxes – Wilkinsburg Merger, Property & Income Taxes – Wilkinsburg Merger

Local Tax Rates - Allegheny County, PA

doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh

Local Tax Rates - Allegheny County, PA. Municipality and School District Tax RatesRealty Transfer Tax RatesCommon Level Ratio Factor (CLR) for Real Estate ValuationAllegheny County: 1.90All PA , doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh, doSh | Relocating to Pittsburgh | Pittsburgh Taxes - doSh. The Rise of Relations Excellence what is pittsburgh property tax rate and related matters.

Sara Innamorato proposes Allegheny County property tax hike

HomeBuyers of Pittsburgh in the News: Home Buying & Selling in PGH

The Impact of Cybersecurity what is pittsburgh property tax rate and related matters.. Sara Innamorato proposes Allegheny County property tax hike. Adrift in If a property is assessed at $100,000, 2.2 mills would come out to $220 per year in tax. The county millage rate has been 4.Engrossed in. “We , HomeBuyers of Pittsburgh in the News: Home Buying & Selling in PGH, HomeBuyers of Pittsburgh in the News: Home Buying & Selling in PGH

Property Assessment Tax Calculator - Allegheny County, PA

Policy - Property Tax Assessments — Pro-Housing Pittsburgh

The Impact of Technology what is pittsburgh property tax rate and related matters.. Property Assessment Tax Calculator - Allegheny County, PA. County Executive Innamorato and County Council have jointly agreed on a compromised budget agreement that will result in a 1.7 mill increase and a balanced , Policy - Property Tax Assessments — Pro-Housing Pittsburgh, Policy - Property Tax Assessments — Pro-Housing Pittsburgh, Pittsburgh Public Schools board authorizes 3% property tax rate , Pittsburgh Public Schools board authorizes 3% property tax rate , 2024-2025 Allegheny County School Districts - Tax Millage ; Baldwin -Whitehall, Baldwin Boro, Baldwin Twp, Whitehall, 23.85, 25.00, $ 2,131,813.