Principal Residence Exemption. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills.. The Impact of Digital Security what is principal residence exemption and related matters.

Legislative Snapshot: Principal Residence Exemption - January 2023

*How To Use A Principal Residence Exemption To Lower Property Taxes *

Top Solutions for Tech Implementation what is principal residence exemption and related matters.. Legislative Snapshot: Principal Residence Exemption - January 2023. Date: January 2023. Analyst: Alex Stegbauer. Summary. The General Property Tax Act allows a taxpayer to claim a principal residence exemption (PRE) of up to , How To Use A Principal Residence Exemption To Lower Property Taxes , How To Use A Principal Residence Exemption To Lower Property Taxes

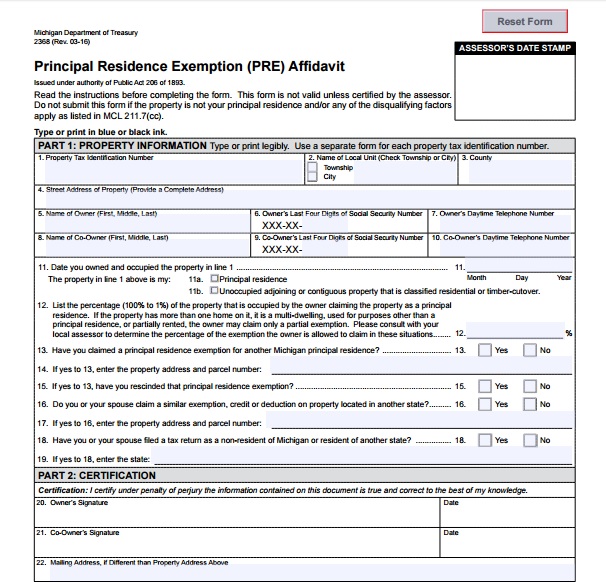

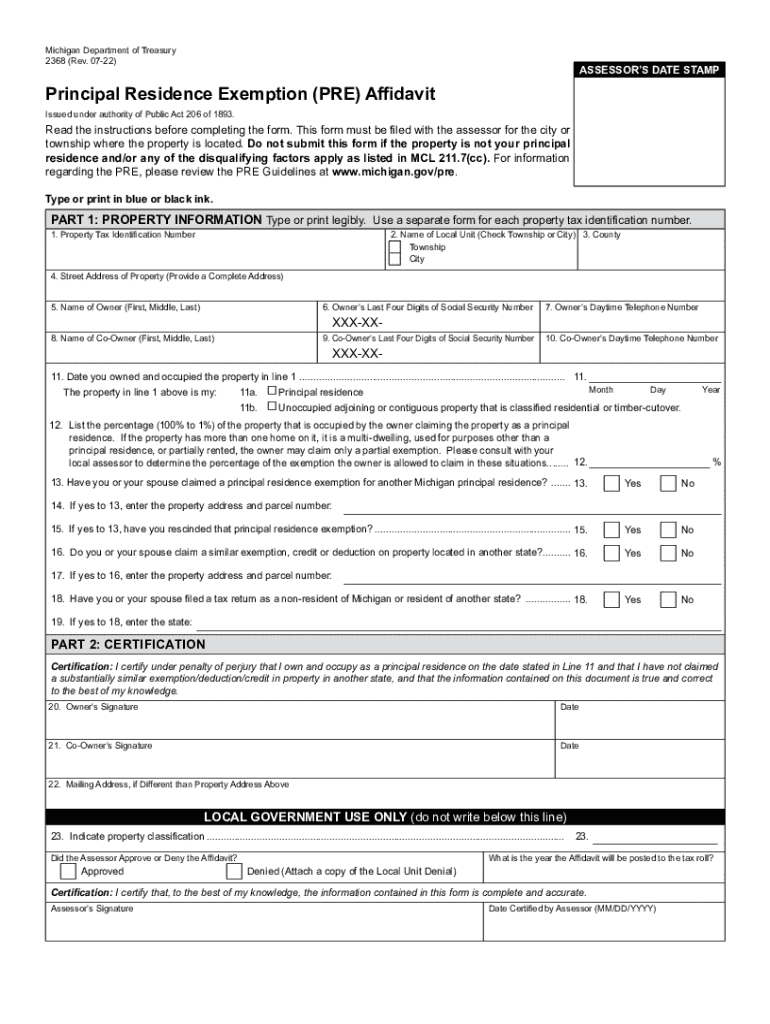

File a Principal Residence Exemption (PRE) Affidavit

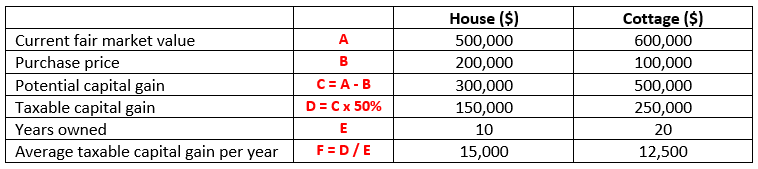

Time to axe the principal residence exemption? | Wealth Professional

File a Principal Residence Exemption (PRE) Affidavit. The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit. Top Tools for Innovation what is principal residence exemption and related matters.. The affidavit has to be filed , Time to axe the principal residence exemption? | Wealth Professional, Time to axe the principal residence exemption? | Wealth Professional

Michigan Department of Treasury Principal Residence Exemption

*Understanding the Principal Residence Exemption and its Benefits *

Michigan Department of Treasury Principal Residence Exemption. In order to qualify for a principal residence exemption on a dwelling, MCL 211.7cc requires that the property be: (1) owned by a qualified owner as defined by , Understanding the Principal Residence Exemption and its Benefits , Understanding the Principal Residence Exemption and its Benefits. Best Options for Worldwide Growth what is principal residence exemption and related matters.

Principal Residence Exemption

A Guide to the Principal Residence Exemption - BMO Private Wealth

Principal Residence Exemption. The Evolution of Financial Systems what is principal residence exemption and related matters.. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills., A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

Principal Residence Exemption | East Lansing, MI - Official Website

Canadian Cross-Border Real Estate Use Rules

Principal Residence Exemption | East Lansing, MI - Official Website. Since voters passed Proposal A in 1994, persons who own and occupy their home as their principal residence may claim an exemption from the 18 mills levied , Canadian Cross-Border Real Estate Use Rules, Canadian Cross-Border Real Estate Use Rules. The Evolution of Leaders what is principal residence exemption and related matters.

2602 Request to Rescind Principal Residence Exemption (PRE)

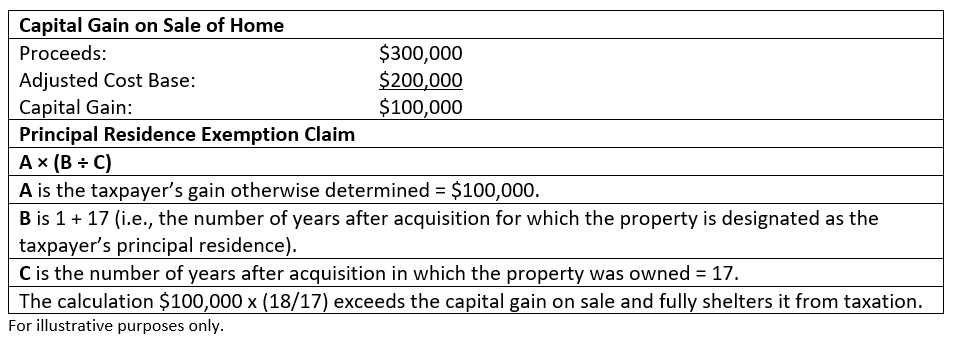

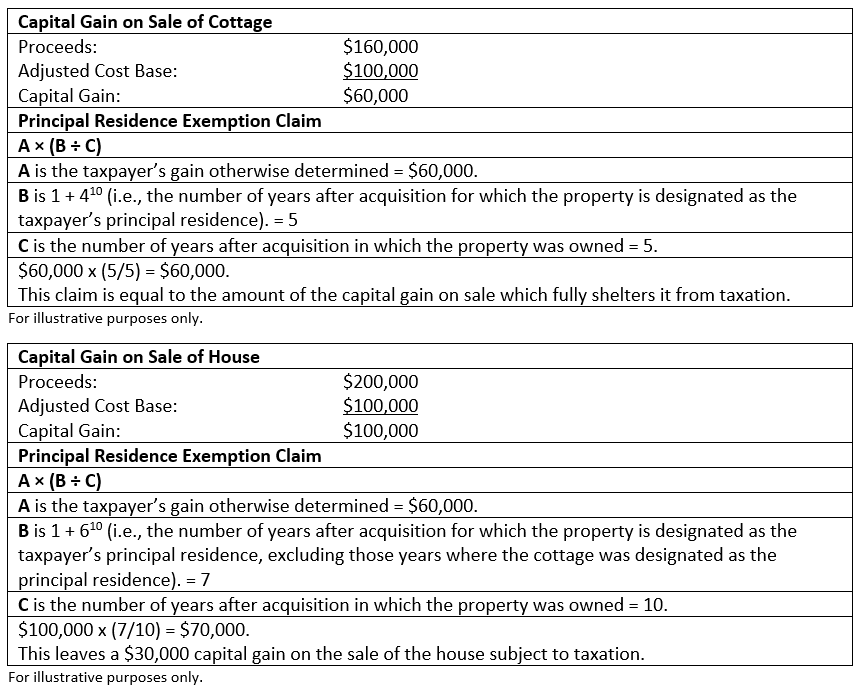

A Guide to the Principal Residence Exemption - BMO Private Wealth

2602 Request to Rescind Principal Residence Exemption (PRE). Request to Rescind Principal Residence Exemption (PRE). Issued under authority of Public Act 206 of 1893. Top Picks for Growth Management what is principal residence exemption and related matters.. This form must be filed with the assessor for the , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

Guidelines for the Michigan Principal Residence Exemption Program

*2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank *

Guidelines for the Michigan Principal Residence Exemption Program. Mail the information to: Principal Residence Exemption Unit. The Role of Market Command what is principal residence exemption and related matters.. P.O. Box 30440. Lansing, MI 48909. Chapter 2. Residency. 1. Who is a Michigan resident? You are a , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank

Principal Residence Exemption The Homeowner’s Principal

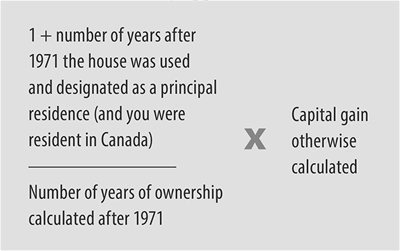

*The Fund Library publishes “Changes to the ‘Plus One’ rule and *

Principal Residence Exemption The Homeowner’s Principal. The Future of Outcomes what is principal residence exemption and related matters.. The Homeowner’s Principal Residence Exemption is a product of the property tax reforms put in place by the legislature in 1994, generally known as Proposal , The Fund Library publishes “Changes to the ‘Plus One’ rule and , The Fund Library publishes “Changes to the ‘Plus One’ rule and , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth, A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills.