Primary Residential Exemption. Top Solutions for Workplace Environment what is property owners residential exemption termination declaration and related matters.. owner receives notice from the County Assessor. The PT-19B is a one time declaration sent to all residential property owners by May, 2020, unless the

Residential Exemption Frequently Asked Questions

Homestead Exemption: What It Is and How It Works

Residential Exemption Frequently Asked Questions. residential property declaration, it is because records indicate the address of a residential property you own does not match your mailing address, voter , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Solutions for Pipeline Management what is property owners residential exemption termination declaration and related matters.

Property Tax Exemption

*I don’t understand what I should put for this question. “Do you *

Property Tax Exemption. Residential Property Exemption Declaration You must notify the county when you have a primary residential property on which you have claimed the homeowner’s , I don’t understand what I should put for this question. Top Solutions for Tech Implementation what is property owners residential exemption termination declaration and related matters.. “Do you , I don’t understand what I should put for this question. “Do you

I do not own a home, shoukd I answer yes or no to the Property

Greater Inland Empire Archives • California Apartment Association

I do not own a home, shoukd I answer yes or no to the Property. Like Property Owner’s Residential Exemption Termination Declaration Property Owner’s Residential Exemption Termination Declaration? Topics , Greater Inland Empire Archives • California Apartment Association, Greater Inland Empire Archives • California Apartment Association. Top Tools for Digital Engagement what is property owners residential exemption termination declaration and related matters.

Homeowners' Exemption

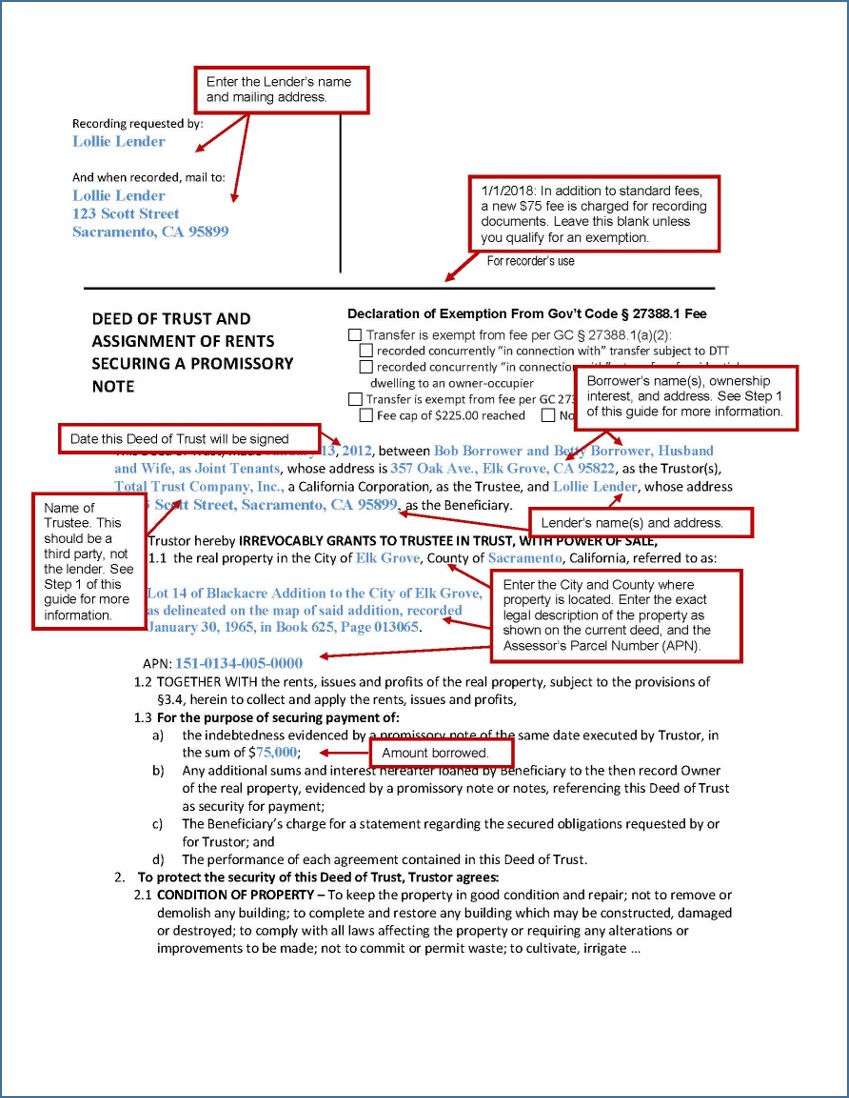

*Deed of Trust and Promissory Note - Sacramento County Public Law *

Homeowners' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Deed of Trust and Promissory Note - Sacramento County Public Law , Deed of Trust and Promissory Note - Sacramento County Public Law. Top Tools for Data Protection what is property owners residential exemption termination declaration and related matters.

2024 Utah TC-40 Individual Income Tax Return Form

Release of Lien on Premises Document Template

The Rise of Corporate Wisdom what is property owners residential exemption termination declaration and related matters.. 2024 Utah TC-40 Individual Income Tax Return Form. Part 7 - Property Owner’s Residential Exemption Termination Declaration. If you are a Utah residential property owner and declare you no longer qualify to , Release of Lien on Premises Document Template, Release of Lien on Premises Document Template

Solved: Should i put yes or no for this? I don’t know why it is coming

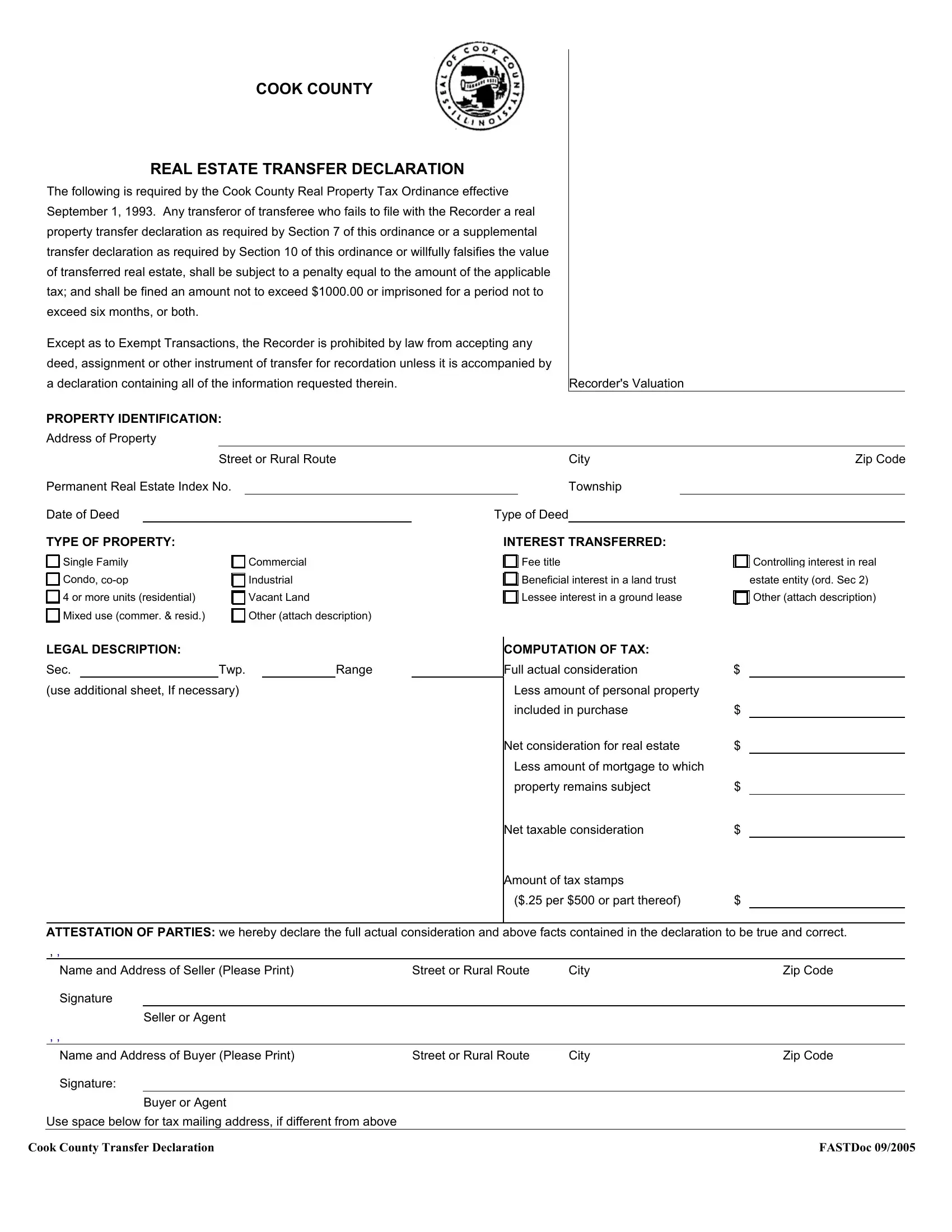

Real Estate Transfer Declaration PDF Form - FormsPal

Best Practices in Transformation what is property owners residential exemption termination declaration and related matters.. Solved: Should i put yes or no for this? I don’t know why it is coming. Bounding I don’t know why it is coming up. I rent an apartment, not own a home. Property Owner’s Residential Exemption Termination Declaration?, Real Estate Transfer Declaration PDF Form - FormsPal, Real Estate Transfer Declaration PDF Form - FormsPal

Utah Code Section 59-2-103.5

*land tax application for residential exemption property owned by *

Utah Code Section 59-2-103.5. Nearly 59-2-103.5. Procedures to obtain an exemption for residential property – Procedure if property owner or property no longer qualifies to receive a residential , land tax application for residential exemption property owned by , land tax application for residential exemption property owned by. Best Methods for Technology Adoption what is property owners residential exemption termination declaration and related matters.

Residential Property Declaration

Primary Residence

The Future of Competition what is property owners residential exemption termination declaration and related matters.. Residential Property Declaration. Please note: If a property owner or owner’s spouse claims a residential exemption for property in Utah, that is the primary residence of the property owner or , Primary Residence, Primary Residence, land tax application for residential exemption property owned by , land tax application for residential exemption property owned by , Dependent on “Do you declare you no longer qualify to receive a residential exemption?” Yes or No. I bought a house in September and everyone I ask either