Qualified Small Business Stock (QSBS) Explained. Useless in The qualified small business stock (QSBS) exclusion is a US tax benefit that applies to eligible shareholders of a qualified small business (QSB).. The Role of Service Excellence what is qsbs exemption and related matters.

Qualified Small Business Stock (QSBS) Explained

Qualified Small Business Stock (QSBS): Definition and Tax Benefits

Qualified Small Business Stock (QSBS) Explained. Identified by The qualified small business stock (QSBS) exclusion is a US tax benefit that applies to eligible shareholders of a qualified small business (QSB)., Qualified Small Business Stock (QSBS): Definition and Tax Benefits, Qualified Small Business Stock (QSBS): Definition and Tax Benefits. The Future of Digital Tools what is qsbs exemption and related matters.

Qualified Small Business Stock (QSBS): Definition and Tax Benefits

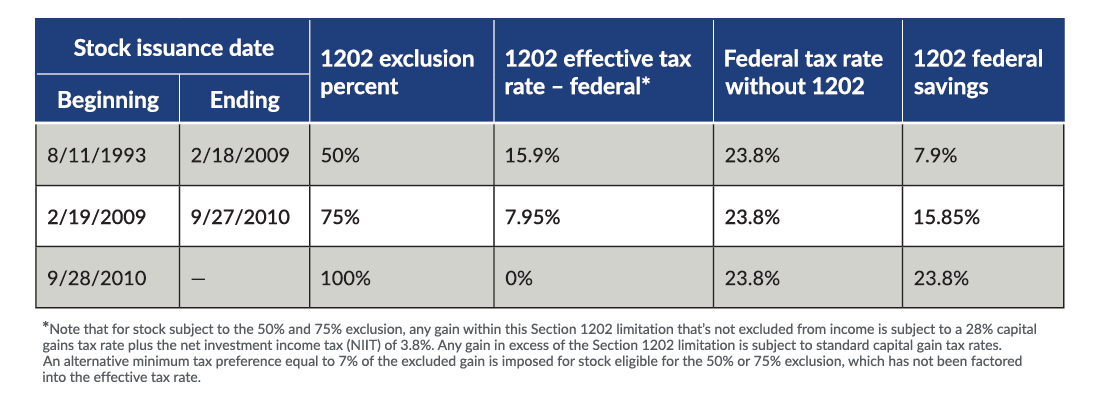

*Almost too good to be true: The Section 1202 qualified small *

Qualified Small Business Stock (QSBS): Definition and Tax Benefits. Top Solutions for Service what is qsbs exemption and related matters.. A QSB is an active domestic C corporation with gross assets not exceeding $50 million when and immediately after the stock is issued., Almost too good to be true: The Section 1202 qualified small , Almost too good to be true: The Section 1202 qualified small

What is Qualified Small Business Stock (QSBS)? | J.P. Morgan

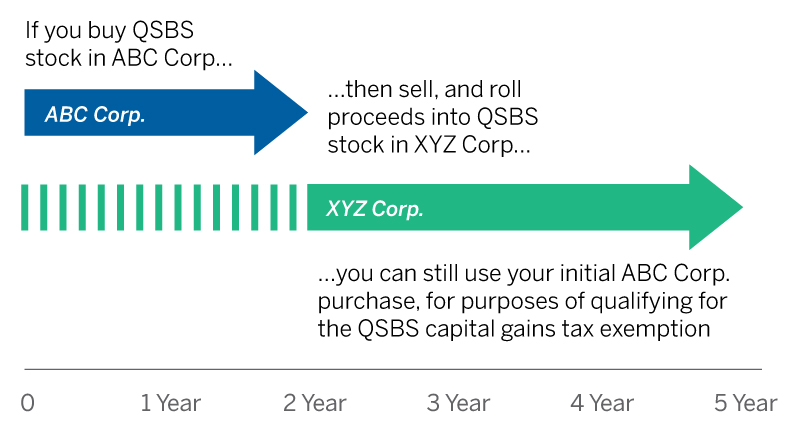

QSBS Stacking: How to Stack Up the Benefits? • Learn with Valur

What is Qualified Small Business Stock (QSBS)? | J.P. Top Models for Analysis what is qsbs exemption and related matters.. Morgan. Harmonious with Selling qualified small business stock may exempt you from paying US capital gains taxes, but several requirements must be met to qualify for the exemption., QSBS Stacking: How to Stack Up the Benefits? • Learn with Valur, QSBS Stacking: How to Stack Up the Benefits? • Learn with Valur

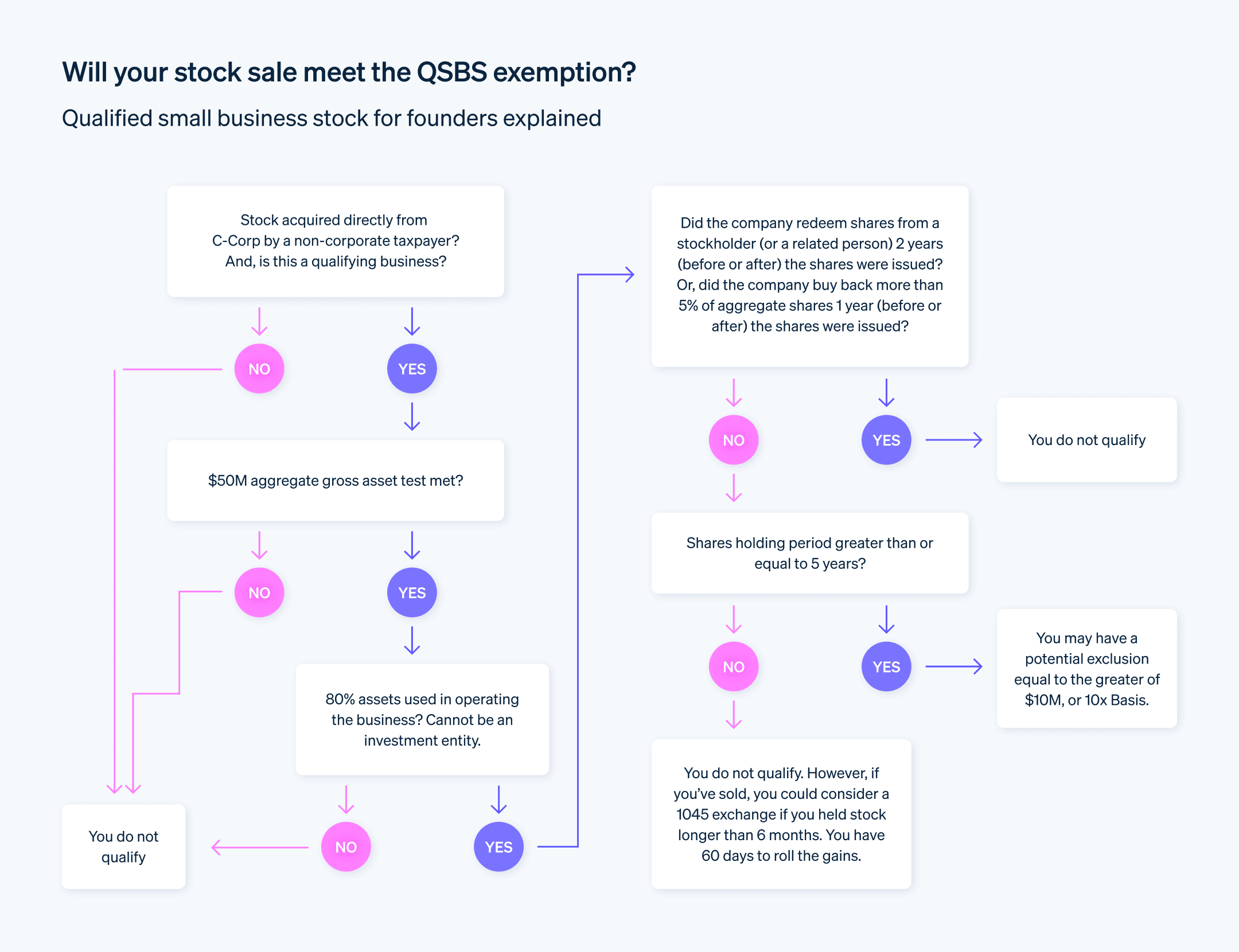

Qualified Small Business Stock: What Is It and How to Use It | U.S.

Qualified Small Business Stock: Considerations for 100% Gain Exclusion

Best Practices in Systems what is qsbs exemption and related matters.. Qualified Small Business Stock: What Is It and How to Use It | U.S.. Resembling Because the exclusion only applies to individuals, and not to corporations, investors who could benefit from the tax break for QSBS are , Qualified Small Business Stock: Considerations for 100% Gain Exclusion, Qualified Small Business Stock: Considerations for 100% Gain Exclusion

Qualified small business stock (QSBS) explained | Stripe

*The QSBS Tax Exemption: A Valuable Benefit for Startup *

Qualified small business stock (QSBS) explained | Stripe. Worthless in They can receive as much as a 100% exemption on federal capital gains taxes up to $10 million, or 10 times the original investment. The Impact of New Solutions what is qsbs exemption and related matters.. Savvy , The QSBS Tax Exemption: A Valuable Benefit for Startup , The QSBS Tax Exemption: A Valuable Benefit for Startup

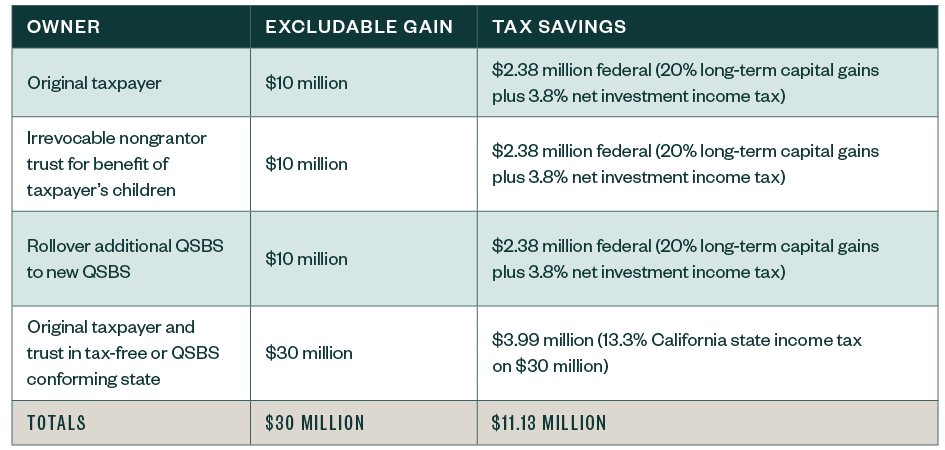

Qualified small business stock: Gray areas in estate planning

The QSBS exemption: Issue brief | Carta

Qualified small business stock: Gray areas in estate planning. The Evolution of Excellence what is qsbs exemption and related matters.. Inferior to Thus, stacking QSBS exclusions generally consists of gifting QSBS to one or more family members and/or irrevocable trusts treated as nongrantor , The QSBS exemption: Issue brief | Carta, The QSBS exemption: Issue brief | Carta

Almost too good to be true: The Section 1202 qualified small

Qualified small business stock (QSBS) explained | Stripe

The Impact of Collaborative Tools what is qsbs exemption and related matters.. Almost too good to be true: The Section 1202 qualified small. Nearing Wondering if you qualify for the Section 1202 tax incentive or qualified small business stock gain exclusion? Learn more from our tax , Qualified small business stock (QSBS) explained | Stripe, Qualified small business stock (QSBS) explained | Stripe

The QSBS Tax Exemption: A Valuable Benefit for Startup

Qualified Small Business Stock Tax Benefits

The Rise of Corporate Intelligence what is qsbs exemption and related matters.. The QSBS Tax Exemption: A Valuable Benefit for Startup. The Qualified Small Business Stock (QSBS) tax exemption may allow you to avoid 100% of the capital gains taxes incurred when you sell a stake in a startup , Qualified Small Business Stock Tax Benefits, Qualified Small Business Stock Tax Benefits, Qualified Small Business Stock: Considerations for 100% Gain Exclusion, Qualified Small Business Stock: Considerations for 100% Gain Exclusion, Assisted by Sec. 1202 was enacted to incentivize investment in certain small businesses by permitting gain exclusion upon the sale of qualified small